At the heart of the fast-paced world of tech startups, lies the ever-crucial aspect of order management.

For startup founders, procurement managers, and technology officers, the smooth execution of order management is more than just a routine process. It’s a determinant of efficiency, profitability, and long-term growth.

However, many startups still rely on traditional, manual order management systems. While these systems may have worked for businesses in the past, they present a plethora of limitations in today’s digital age.

Manual processes, with their inherent inefficiencies, often lead to errors, delays, and mismanagement. The repercussions? Costly mistakes, compromised supplier relationships, and a detrimental impact on the overall business reputation.

But as with many challenges in the modern business realm, technology offers a solution. Enter the era of Procure-to-Pay Automation. In the subsequent sections, we’ll delve deep into how this innovation is becoming a game-changer for tech startups eager to re-envision their order management systems.

What Is Order Management?

Order management, simply put, is the comprehensive system that facilitates and oversees the life cycle of an order, from inception to delivery. This includes tasks such as tracking orders, managing inventory, overseeing shipment, and ensuring that payment processes are streamlined.

Given the significance of these tasks, it’s no surprise that tech startups prioritise the optimization of this function.

How did Procure-to-Pay Automation Come About in Startups?

In recent years, there has been a significant transformation in the operational dynamics of tech startups, especially in the realm of procurement and order management.

One of the most compelling shifts has been the increasing adoption of Procure-to-Pay Automation. This trend isn’t merely a fleeting phase; it’s a calculated response to the limitations and inefficiencies associated with manual order management systems.

What is Procure-to-Pay Automation?

At its core, procure-to-pay (P2P) is a process that encompasses the entire cycle from procuring goods and services to paying suppliers. It’s an end-to-end solution that begins with the identification of a need within the organisation and concludes with the settlement of bills and invoices.

So, when we talk about Procure-to-Pay Automation, we are referring to the integration of digital tools and software solutions. These help streamline, optimise, and automate each of these steps.

To understand this better, consider the following elements of a typical P2P cycle:

- Requisition : Identifying a need for a product or service.

- Approval : Getting the necessary internal sign-offs to proceed with a purchase.

- Purchase order : Formally documenting and placing the order.

- Receiving : Taking delivery of the ordered items.

- Invoice reconciliation : Ensuring that the invoice matches the order and delivery.

- Payment : Completing the transaction by paying the supplier.

In traditional setups, each of these steps could involve cumbersome manual processes, paperwork, multiple approval hierarchies, and potentially long wait times. With Procure-to-Pay Automation, tech startups can now drastically reduce these inefficiencies.

Automated workflows replace manual handoffs, digital records supersede paper trails, and real-time analytics offer insights that drive strategic decision-making.

Why are Tech Startups Embracing P2P Automation?

There are several reasons for the upsurge in the adoption of Procure-to-Pay Automation among tech startups:

- Cost Optimization : Automation significantly reduces processing costs associated with order management, minimises errors, and avoids unnecessary expenses tied to manual mishaps.

- Enhanced Efficiency : Automated processes speed up the procurement cycle, ensuring that startups can rapidly respond to their operational needs.

- Improved Supplier Relationships : With timely payments, transparent communication, and fewer errors, startups can foster trust and collaboration with their suppliers.

- Data-driven Decisions : Automated P2P solutions often come equipped with analytical tools, allowing startups to glean insights. These include details into their spending habits, supplier performance, and potential areas for savings.

Why Procure-to-Pay Automation is a Game-Changer?

In the dynamic environment of tech startups, challenges are a constant. They come fast, demand immediate attention, and often carry significant implications.

Order management, being central to a startup’s operations, is no exception. It’s riddled with complexities that can impede a startup’s momentum.

Here’s where Procure-to-Pay Automation enters the picture, proving to be a true game-changer for startups. Let’s delve into the specific challenges in startup order management that this innovation addresses.

- Time-Consuming Manual Processes:

Challenge

Traditional order management systems are notorious for their manual processes, requiring extensive human involvement at every stage, from requisition to payment. This not only consumes valuable time but is also prone to human error.

Solution

With Procure-to-Pay Automation, startups can automate routine tasks, dramatically reducing the time spent on order processing. Automated workflows, digital approvals, and streamlined purchasing allow startups to operate at peak efficiency.

- Limited Visibility into Spending

Challenge

Manual and disjointed systems can make it difficult for startups to have a clear view of their expenditure. This lack of visibility can lead to budget overruns and missed opportunities for cost optimization.

- Solution

Automated P2P platforms provide real-time analytics and detailed reporting, giving startups complete transparency into their spending habits. This empowers them to make data-driven decisions and strategically allocate resources.

- Supplier Relationship Strains

Challenge

Delays in payments, errors in order processing, and lack of communication can strain supplier relationships. But these are vital for startups to maintain a steady supply chain.

Solution

Procure-to-Pay Automation enhances supplier collaboration by ensuring timely payments, accurate order processing, and transparent communication. A harmonious supplier relationship translates to more favourable terms and better negotiation outcomes for startups.

- Compliance and Risk Management Concerns

Challenge

Keeping up with regulatory changes, managing contract terms, and ensuring data security can be daunting for startups, especially when relying on outdated systems.

Solution

Modern Procure-to-Pay Automation solutions come equipped with built-in compliance tools, ensuring startups adhere to industry standards and regulations. Furthermore, they provide robust security features to safeguard sensitive data, mitigating risks.

Scalability Issues

Challenge

As startups grow, so do their operational demands. Manual systems can become increasingly cumbersome, hindering the startup’s ability to scale seamlessly.

Solution

Automated P2P solutions are inherently scalable. As a startup expands its operations, the system can effortlessly accommodate increased order volumes, supplier integrations, and additional procurement complexities.

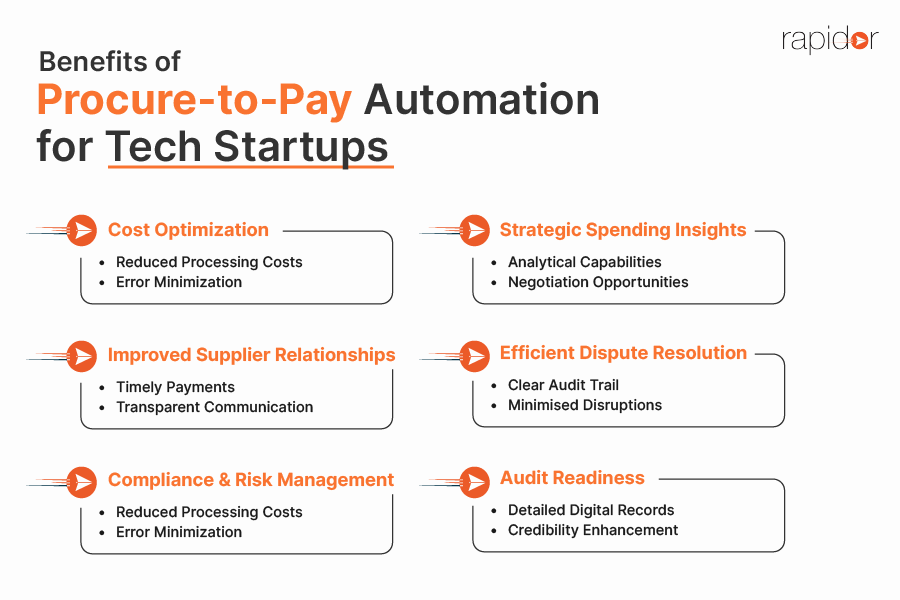

What are the Benefits of Procure-to-Pay Automation?

The advent of Procure-to-Pay Automation in the domain of tech startups signifies a shift from traditional processes to modern, streamlined, and efficient systems. But what exactly does this shift bring to the table?

The answer lies in a multitude of tangible benefits that directly impact a startup’s bottom line and strategic positioning. Let’s delve into some of the most impactful advantages.

Cost Optimization

One of the paramount goals of any startup is to operate within budgetary constraints while maximising value. Procure-to-Pay Automation plays a vital role here.

- Reduced Processing Costs

Automated workflows, digital documentation, and electronic invoicing eliminate the costs associated with manual handling, printing, and storage.

- Error Minimization

With automation, the chances of human errors—such as double entries, miscalculations, or misplaced orders—are significantly reduced, saving startups from costly rectifications.

- Strategic Spending Insights

The analytical capabilities of P2P platforms offer startups a clear view of their spending patterns. This helps them identify opportunities for negotiations, bulk purchases, or alternative supplier options.

Improved Supplier Relationships

In the business ecosystem, fostering strong supplier relationships is as crucial as maintaining customer relationships. P2P automation is a catalyst in this realm.

- Timely Payments

Automation ensures that payments are processed on time, enhancing the trust factor with suppliers.

- Transparent Communication

With centralised platforms, startups can maintain clear communication channels with suppliers, updating them on order statuses, payment schedules, and any potential changes.

- Efficient Dispute Resolution

In the rare event of discrepancies, automated systems provide a clear audit trail, facilitating quicker resolution and minimising disruptions.

Better Compliance and Risk Management

Navigating the intricate web of regulations, standards, and contractual obligations can be daunting. However, P2P automation offers tools to manage these challenges adeptly.

- Integrated Compliance Tools

Modern P2P platforms come equipped with tools that ensure transactions and processes align with prevailing industry standards and regulations. As a result, startups can avoid potential legal pitfalls.

- Secure Data Management

Procure-to-Pay Automation solutions prioritise data security, providing robust encryption and security protocols. This ensures that sensitive transactional data, supplier information, and financial records remain protected from breaches.

- Audit Readiness

Automated systems maintain detailed digital records of every transaction, making audits less cumbersome and more transparent. This not only reduces the time and effort required for audit preparations but also enhances the credibility of the startup.

How to Implement Procure-to-Pay Automation?

Embarking on the journey of Procure-to-Pay Automation is a pivotal move for tech startups aiming to optimise their order management systems. However, implementation isn’t just about choosing a software solution and activating it.

It’s a comprehensive process that requires careful planning, selection, and training. Let’s break down the steps needed to ensure a seamless and successful transition to an automated P2P system.

Assess Current Processes and Identify Needs

Before diving into the world of automation, startups must introspect and evaluate their existing order management processes.

- Audit Current Workflow

Understand the existing workflow, identify bottlenecks, and ascertain areas that can benefit most from automation.

- Define Objectives

Clearly outline what you hope to achieve with the automation, be it cost optimization, better supplier relationships, or enhanced compliance mechanisms.

Research and Select the Right Software

The market is flooded with P2P solutions, but the key is to select one that aligns with the startup’s specific needs.

- Features and Functionality

Ensure the software offers features relevant to your business needs, such as multi-currency support, integrated analytics, or supplier portals.

- Scalability

Choose a platform that can grow with your startup, accommodating increased volumes and complexities in the future.

- User Reviews and Testimonials

Look for reviews from businesses of similar scale and industry to gauge the software’s efficacy.

Engage Key Stakeholders

For successful implementation, it’s crucial to have the buy-in of all relevant parties.

- Executive Buy-in

Ensure top management understands the value and benefits of the proposed system.

- Supplier Engagement

Communicate with key suppliers, informing them of the impending change and its advantages for collaboration.

Conduct Comprehensive Training

A system is only as effective as its users. Proper training ensures that staff can utilise the platform to its full potential.

- Workshop Sessions

Organise in-depth training sessions covering all features of the software.

- Real-time Simulations

Allow users to work on mock scenarios, giving them hands-on experience.

- Continuous Learning

As updates or new features roll out, ensure continuous learning opportunities to keep staff updated.

Migrate Data and Integrate Systems

Transitioning to a new system requires meticulous data migration and system integration.

- Data Cleansing

Before migrating, cleanse the data of any redundancies or errors.

- Integration with Existing Systems

Ensure the P2P platform can integrate seamlessly with existing systems like ERP or CRM, allowing for holistic data flow.

Roll-out and Monitor

Once the system is in place, it’s time to activate it and observe its performance.

- Phased Roll-out

Instead of a full-fledged launch, consider a phased roll-out, starting with select departments or processes.

- Continuous Monitoring

Use analytics to monitor the system’s performance, ensuring it’s delivering the expected results and benefits.

Seek Feedback and Optimise

After implementation, continuously seek feedback from users and suppliers to fine-tune the system.

- Feedback Loops

Encourage users to provide feedback on challenges or inefficiencies they encounter.

- Iterative Optimization

Based on feedback and performance metrics, make necessary adjustments to the system for optimal performance.

What does the Future of Tech Startups Look Like?

The landscape of tech startups is one characterised by agility, innovation, and an unwavering quest for efficiency.

Amidst this backdrop, order management stands out as a critical pillar, directly influencing operational success, supplier relationships, and bottom-line results. It’s here that the transformative power of Procure-to-Pay Automation takes centre stage.

From the intricacies of day-to-day operations to the broader strategic vision, Procure-to-Pay Automation redefines the very essence of order management for startups. No longer are startups bound by the limitations and inefficiencies of manual processes.

Instead, they have at their fingertips a solution that offers unparalleled cost optimization. Additionally, it fosters harmonious supplier relationships, and ensures robust compliance and risk management mechanisms.

To all the startup founders, procurement managers, and technology officers out there: take a moment to assess your current order management systems. Assess, consider, and let the transformative journey of Procure-to-Pay Automation begin.

The rewards, as you’ll soon discover, are profound and lasting.